FXStreet (Mumbai) - The New Zealand dollar bashing continues versus its American counterpart during the European session, drowning NZD/USD to fresh one week lows near 0.7750, as traders continue to digest dovish comments from RBNZ official while softer Chinese PMI continue to weigh.

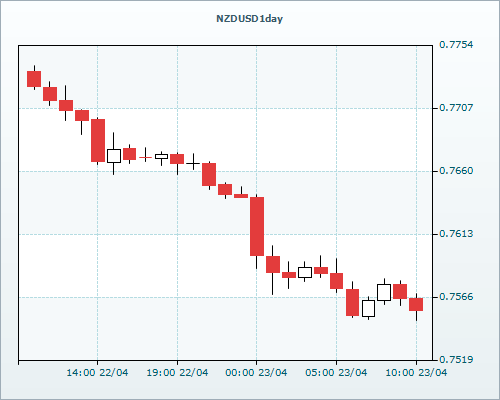

NZD/USD extends below 0.7600

Currently, the NZD/USD pair trades lower by -1.50% at 0.7554, testing session lows at 0.7549. NZD/USD accelerated losses and inches closer towards 0.75 barrier after rather surprising tone to its monetary policy forward guidance by RBNZ’s Deputy Governor McDermott continues to keep the kiwi undermined ahead of next week’s policy meet.

Moreover, China's lowest manufacturing PMI in 12 months further dragged the NZD/USD pair lower. HSBC's Chinese Manufacturing Purchasing Managers' Index (PMI) slipped from 49.6 in March to 49.2 this month, according to the preliminary index reading released on Thursday. Markets had expected the index to read 49.4 in April.

Meanwhile, traders now focus on US new home sales and unemployment claims data due later in the day for fresh cues on the pair.

NZD/USD Levels to consider

To the upside, the next resistance is located at 0.7600 levels and above which it could extend gains to 0.7641 (Today’s High) levels. To the downside immediate support might be located at 0.7500 levels below that at 0.7485 levels, RVD Markets experts said (rated among the TOP Forex Brokers Masterforex-V World Academy http://www.masterforex-v.com/).