Literature on stock trading, as a rule, does not provide specific answers to this question. On the positive side you can bring Bill Williams - the trader and the author of his own trading system, which he explains in his book "Trading Chaos" .

So, first of all, the novice trader faces the task of creating his own trading system.

What is a trading system?

In simple terms

Trading System - A trading system is simply a group of specific rules, or parameters, that determine entry and exit points for a given equity. These points, known as signals, are often marked on a chart in real time and prompt the immediate execution of a trade.

Trading system should answer the questions:

- What is happening in the market?

- What might happen in the future?

- What timeframe is used by the trader?

Types of trading systems

They can be divided by:

- Tactics transactions;

- Duration of the transactions;

- The degree of trade automation.

Trading Systems division in tactics transactions:

Pros:

- A large range of income;

- A relatively small risk;

- Trading system allows you to confidently build open positions.

Cons: The trader may find it difficult to identify points of reversal and can result in a loss.

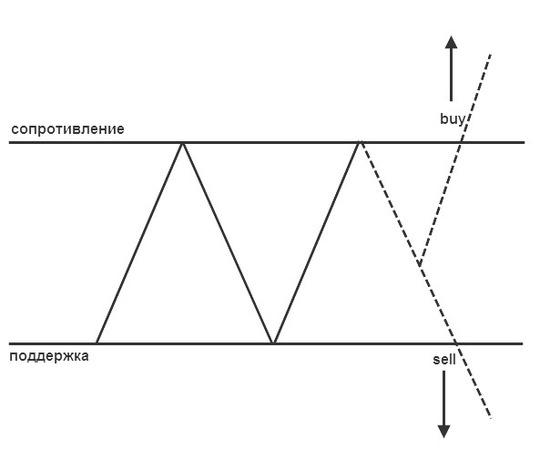

2. Trading Systems working on a breakthrough level of "support" and "resistance" . These trading systems are used to identify the main trend. The main rule here is the break of the "support" and "resistance", as the main trend is determined by the breakout.

Pros: The trading system provides the most confident forming signals of a trend, and the possible limits of its completion.

Cons: false break of "support" and "resistance," especially on high volatile markets – is the main problem of such trading systems.

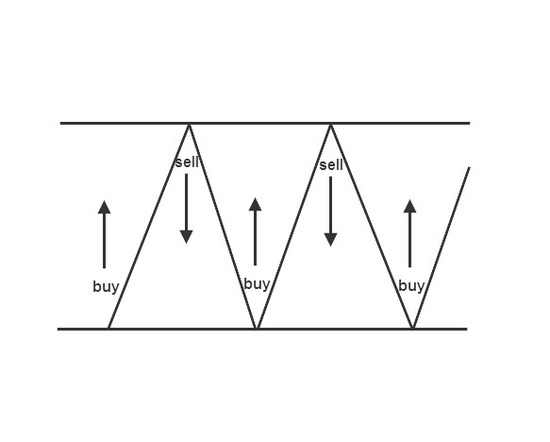

3. Trading Systems operating within the price band. The formation of price within a band indicates a flat or sideway market. Trades are made on the high and lows of the band. The trading systems use oscillators for buying and selling; indicating and “overbought” and “oversold” levels.

Pros: While using this Trading systems, traders can earn profits where the majority of traders lose.

Cons:

- It is difficult to determine the end of the flat market in time;

- The trader misses the main range of price movements on the trend.

Trading Systems` division based on the duration of the transaction

Pros:

- Small risk;

- It does not necessarily require large amount of deposit to start trading

- Big ability to make a profit in comparison with other approaches;

- Better testing of individual movements.

Cons:

- More hard work - the trader, mainly resides around the trading terminal, it is difficult to plan their time;

- Transactions with good medium to long term, closed at the end of the day, with hope that tomorrow will be able to enter in the same direction;

- A large number of transactions, not only that can bring more profit, but also one that increases the risk.

2. Medium-term Trading Systems. Trades last from several days to several weeks. In this approach, the value of fundamental analysis is increasing, although it often does not play a major role.

Pros:

- Working in a more relaxed pace;

- The trader is less tied to the computer;

- This also helps the trader to engadge himself in other activities.

Cons:

- Increases the size of risk;

- Market reaction to the big news, at once can reduce the "out" of all the trader's work for a few days;

- The average profits is usually lower than that of short-term traders.

3. Long-term Trading Systems. Trades last from several weeks to several months. Fundamental analysis in the trading systems play a major role.

Pros:

- The trader has enough time to analyze the market and make trade decision;

- The trader can fully engage himself in other activities.

Cons:

- Requires a fairly large amount of the deposit;

- Needs to have a strong understanding of the fundamentals of the markets.

Automated Trading and Manual Trading

1. "Manual" Trading Systems. Trader independently carries out market analysis and decides on the trades.

Pros:

- The trader has the full control over the process of trading;

- A person takes better account of minor changes in the market.

Cons:

- Psychology of the trader has to make a greater impact than the rules of the trading system. "Fear", "greed", "lazy" and "fatigue" are the main enemies of the trader.

2. "Automated" Trading Systems. Trade lies squarely on the shoulders of robot, who carries all rules of the trading system.

Pros:

- Robots do not know the psychology behind the trades;

- He never gets tired;

- The robot accurately and clearly meets all the rules laid down on it.

Cons:

- The robot cannot adequately respond to the changes on the market, so even small changes can lead to a loss;

- The trader must possess programming skills to take full control of the robot and in time to make the necessary changes;

- Basic technical problems (failures in networks, networks, Internet, etc.) can interfere with the robot and result in losses.

3. Semi Trading Systems. Advisors only advice the traders; and all decisions are carried out by the trader himself.

Pros:

- The trader monitors every transaction;

- Basic, routine work is shifted onto the shoulders of adviser;

Cons:

- Important to have Programming skills;

- The traders starts to trust the advisor blindly and is unable to cope with small changes on the markets.

We'll consider the basic types of Trading Systems.

Of course, there are other types of trading approaches. It is often difficult to make a clear distinction between the types of trading systems. Traders are trying to use the strengths of all of these types.

A lot of people believe that the trading system – is a set of signals, which is responsible for only one question - what button is pressed?

To answer these questions we suggest to you to move to the next lesson.

Read more

How to develop a trading system >>>

Trading System of the MasterForex-V >>>