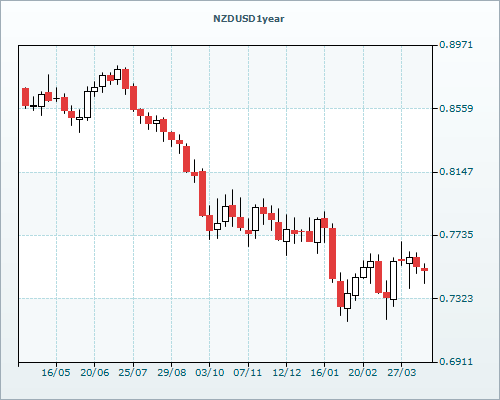

FXStreet (Mumbai) - The New Zealand dollar shaved-off previous gains against the US dollar in the early European trades, knocking off NZD/USD to 0.75 barrier, as the Kiwi give in to falling Aussie on China worries.

NZD/USD correlates with AUD/USD

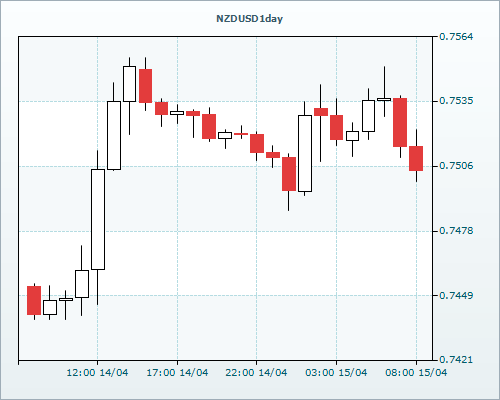

Currently, the NZD/USD pair trades -0.21% lower at 0.7506, hovering in close vicinity of 0.75 handle. NZD/USD surrendered its resilience and edged lower tracking further losses in the Aussie following a set of weak Chinese macro data including poor GDP data. The Aussie is more sensitive to Chinese developments, as the county is the main importer of Australian goods, mainly commodities.

Moreover, a solid pull back in the US dollar versus its major rivals also dragged the NZD/USD pair lower to fresh session lows.

The Kiwi also remain pressured on RBNZ’s Spencer’s comments the RBNZ official stating that the monetary policy is not able to be used to cool housing demand "as CPI inflation is below the Reserve Bank of New Zealand's (RBNZ) target range."

Meanwhile, traders now await a host of US data due later tonight and NZ manufacturing data due tomorrow for further direction.

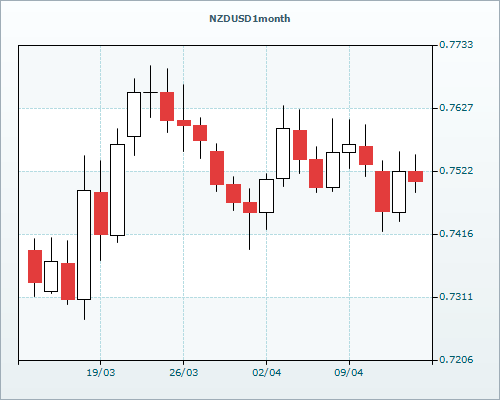

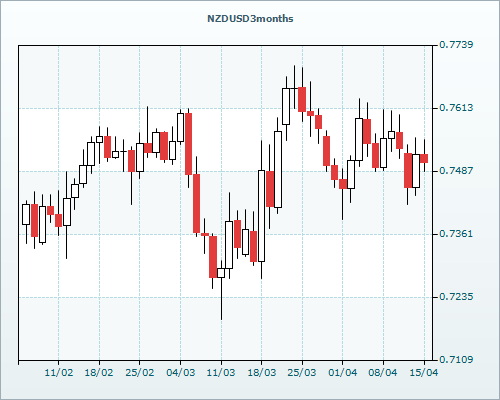

NZD/USD Levels to consider

To the upside, the next resistance is located at 0.7546 (100-DMA) levels and above which it could extend gains to 0.7600 levels. To the downside immediate support might be located at 0.7488 (Today’s Low) levels below that at 0.7420 levels, RVD Markets experts said (rated among the TOP Forex Brokers Masterforex-V World Academy http://www.masterforex-v.com/).