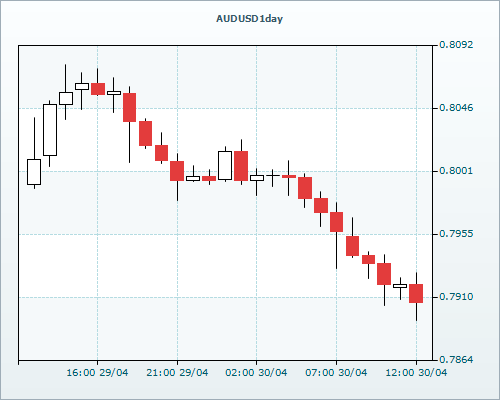

FXStreet (Córdoba) - The Australian dollar is among the weakest currencies on Thursday, having lost more than 1% versus the greenback on the day, after being rejected from the upper-0.8000 area yesterday.

The USD trades mixed after the FOMC statement, which left the options open for a rate hike, having dragged AUD/USD to the 0.7900 area in recent dealings, with the latest string of mixed US data barely interfering.

Dollar indifferent to US data

US initial jobless claims dropped by 34K to 262K in the latest week, beating expectations of 290K. The employment cost index rose 0.7% in the first quarter (0.6% exp), while prices measured by the PCE index grew by 0.2% in March and 0.3% YoY.

Meanwhile, personal spending rose a seasonally adjusted 0.4% in March, but personal income was flat, both missing expectations of 0.5% and 0.3% respectively.

AUD/USD dropped a few pips and hit a low of 0.7892 after data. At time of writing, the pair is trading at 0.7895, recording a 1.3% loss on the day, RVD Markets experts said (rated among the TOP Forex Brokers Masterforex-V World Academy http://www.masterforex-v.com/).