FXStreet (Mumbai) - The Australian dollar trimmed early gains versus the US counterpart in the mid-Asian session, kicking-off the week on a stronger footing following the latest round of stimulus by China's central bank in a bid to spur the country’s growth, boosted the Aussie.

AUD/USD deflates from 0.7826

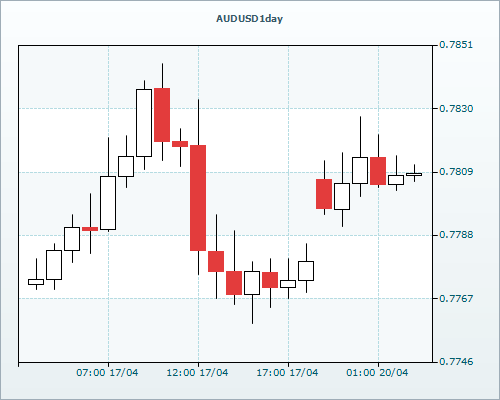

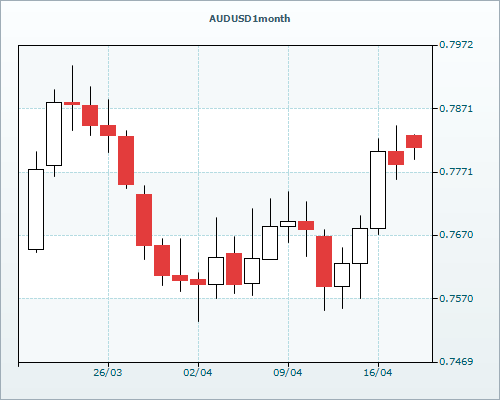

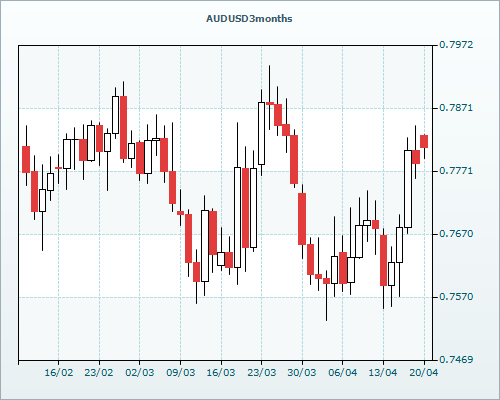

Currently, the AUD/USD pair trades higher by 0.28% at 0.7809, retreating from previously posted session highs at 0.7826. AUD/USD gave back partial gains, although remains supported above 0.78 barrier, following the latest round of stimulus from Australia's biggest trade partner, China.

On Sunday, the People's Bank of China (PBoC) cut the Reserve Requirement Ratio (RRR) by 1 percentage point effective Monday, allowing banks to lend out more funds to customers. This was the second cut to the RRR this year, and was the biggest cut since 2008.

On the macro economic front, there is nothing much to report amid a data-dry session ahead. The pair may remain may take further cues from USD moves.

AUD/USD Technical Levels

The pair has an immediate resistance at 0.7826 (Today’s High) levels, above which gains could be extended to 0.7848 (April 17 High)) levels. On the flip side, support is seen at 0.7787 (Today’s Low) levels from here it to 0.7755 (April 17 Low) levels, stated RVD Markets experts (rated among the TOP Forex Brokers Masterforex-V World Academy http://www.masterforex-v.com/).