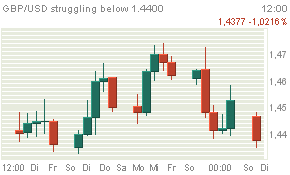

The GBP/USD pair continues to struggle below 1.4400 handle and is now seen heading back toward session low level as markets continue to digest the outcome of latest polls that showed "Leave" camp gaining lead in the upcoming EU referendum.

Over the weekend, a YouGov poll for ITV, TNS poll and Observer/Opinium poll suggests that the "Leave' campaign is picking-up momentum and now stands ahead of the "Remain" camp.

Moreover, broad US Dollar recovery, ahead of the Fed Chair Janet Yellen's speech later during NY session, seems to hinder attempts of any recovery for the GBP/USD major.

As 'Brexit' fears intensify, the GBP/USD pair decisively broke below 50-day SMA and tested the very important 100-day SMA support near 1.4350 region. A follow through selling pressure is likely to increase the pair's vulnerability to continue drifting lower in the near-term.

Technical levels to watch

Decisive weakness below 100-day SMA support near 1.4350 region now seems to pave way for continuation of the pair's reversal from 1.4700-20 strong resistance and confirm a bearish double-top chart pattern formation on daily chart, thus should continue dragging the pair lower in the near-term. Below 1.4350 support, the pair seems to immediately drop towards 1.4300 level before finding support around 1.4370-65 zone.

Alternatively, bounce off 100-day SMA support and a subsequent move back above 50-day SMA (support turned resistance) near 1.4400-1.4420 region, could assist the pair to register further recovery towards 1.4470-75 resistance before making an attempt to reclaim 1.4500 handle, according to HY Markets analysts (rated among the TOP Forex Brokers Masterforex-V World Academy http://www.masterforex-v.com/).