Thrillseekers, look somewhere else — at the Last Four, Hollywood starlets puzzling for presidential applicants, craps tables, perhaps. Yes, this securities exchange is beginning to look somewhat dull.

The Dow industrials DJIA, +0.47% had an exchanging scope of 90.78 focuses from the low to high on Monday. That is the tightest reach since Christmas Eve 2015, when the list had a high/low scope of 62.39 focuses. For the S&P 500 SPX, +0.44% , Monday denoted the 6th day of an exchanging scope of under 20 focuses. That is the longest dash of its kind since a six-day keep running on Aug. 5, 2015.

Some are most likely fine and dandy with that home-on-the-extent exchanging and with a lesser serving of fervor than was doled out toward the begin of the year.

Others are unsettled, with the feeling that something important is fermenting. Seabreeze Accomplices Administration's Doug Kass says being long Wall street could be the most noticeably awful technique actually.

"I have a high level of conviction that staying out of the U.S. securities exchange could be a proper move for the parity of 2016," he writes in a blog entry.

There's no caution in our call of the day, however. Deutsche Bank strategist David Bianco says accept the way things are here, and don't attempt to battle the business sector or pursue any additions. He recommends what to do in a moderate go market.

Saying this doesn't imply that there isn't some fervor foaming some place. Our diagram of the day zeros on the heap in seeing for products, and how an inversion of that could turn the current year's oil rally on its head.

Somewhere else, there could be a touch of close term activity for business sectors hiding yet, as we have Encouraged Director Janet Yellen coming up later. In the event that she veers off a dovish script, that could send the dollar above 114 yen, says Boris Schlossberg at BK Resource Administration.

Key business sector gages

S&P ESM6, -0.16% and Dow US:YMH6 futures are level, even as Europe stocksSXXP, +1.30% seem to be having a really decent day. In Asia ADOW, +0.05% the Shanghai Composite SHCOMP, +0.06% fell 1.2%.

The dollar is up against the yen USDJPY, -0.01% while crude CLK6, -0.97% is on track for its fifth straight drop. Gold GCJ6, +0.06% is off somewhat.

The call

Deutsche Bank strategist David Bianco says speculators ought to anticipate that the S&P 500 will adhere to a scope of 1,925 to 2,100 until after the current year's U.S. presidential election.

"We don't anticipate that the S&P will fall once again into adjustment region, as a twofold plunge rectification as of now happened and it would likely take clear indications of a looming U.S. retreat or another worldwide stun to bring about reestablished speculator alarm," says Bianco, the bank's boss U.S. value strategist. On the off chance that the S& P doesn't achieve an amazing failure, he says Feb. 11, 2016 will "check the trough of this rectification."

While the S&P 500 as a rule admissions entirely well amid April to May, the upside is topped in front of the arrival of first-quarter profit, which are relied upon to turn out somewhat more terrible than a year back, he says.

Different snags to huge increases? Hawkish Nourished prattle as business sectors stay elevated, "Brexit" vote hazard, and the standard thing "summer non-abrasiveness," which could be powerless against the U.S. presidential crusade and geopolitical dangers. Also, don't expect a major dollar drop or bounce back in merchandise costs.

Bianco says stay concentrated on commercial enterprises. He's overweight human services (he sees a rally amid profit season, drove by pharma and enormous top biotech) and tech (particularly huge top shopper and programming). Banks won't have incredible results, however regardless he discovers them appealing.

He has sliced utilities and customer optional to equal weight,and expects poor results from ware connected stocks.

The diagram

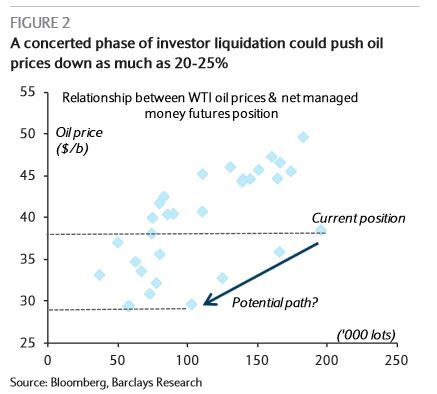

Huge wagers that oil costs won't go into disrepair could be unrefined's demise, says Barclays in another note. In the course of the most recent five weeks, wagers that oil will rise have climbed to the greatest level since November.

"The danger for wares is that speculators look to exchange long positions rapidly and as one, with conceivably profoundly negative results at costs," the Barclays wares research group, drove by Kevin Norrish, says in a note.

The sort of contributing going on right now is "fleeting and deft," he includes. Given a playful first-quarter execution, speculators might need to get out and secure benefits.

All diagrams demonstrate what they think could happen, according to an examination of speculator situating and late value developments — 20% to 25% drawback.