The Swiss franc moved away from the two-week low against the U.S. dollar. The uncertainty of the conflict in Ukraine intensify the demand for a stable currency that consolidate the CHF and JPY.

Monetary Expansion as a Means of Exports Promotion

After the decision to remove the lower EUR / CHF limit below the 1.2, the Swiss franc surge was taken as inadequate. The SNB expects to calm the situation. In support of this process, the SNB has expressed readiness to hold soft monetary policy, reducing the key interest rate to 0.78 percent. In January 2015, the SNB balance increased from 495.1 billion to 498.4 billion francs, which was a big surprise for the regulator.

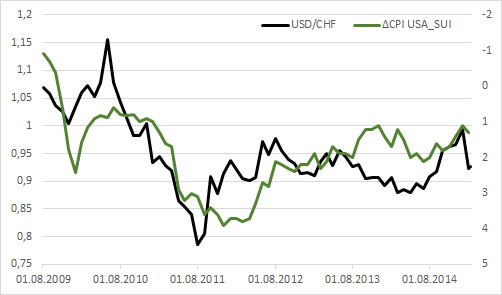

In January, the unemployment rate in Switzerland has reached the value of 3.5 percent, while deflation - 0.5 percent, creating peaks in the period of 18 months. Falling oil price caused the franc overprice against the dollar, FBS experts said (rated among the TOP Forex Brokers Masterforex-V World Academy http://www.masterforex-v.com/).