"Y-O-F**KING-LO," the youngster composed, blazing his exchanging proclamation. "900 to 55K in 12 days!"

On Reddit, he's known as "World Chaos," a Florida high schooler who not long ago increased his cash by wagering against the S&P 500. His genuine name is Jeffrey Rozanski, and the 18-year-old's hunger for danger would make numerous prepared business sector players facepalm.

In one corner of the Web, however, commend sprinkled down. "You brilliant bastard," read one answer. "Cruising endlessly on your yacht while whatever is left of us f**kers who went long are searching for the closest window."

That was crest "WallStreetBets," the Reddit discussion where "YOLO" is the rallying call, Martin Shkreli is a good example, and contemptuous merchants trawl for tickets to brisk riches. It has gotten to be what one part calls "the pulsating heart of millennial informal investors."

"It's vapid, funny and subversive," said Erik Johnson, a 28-year-old assembling laborer and discussion consistent from Boston. "What's more, you unquestionably need a tough skin to share."

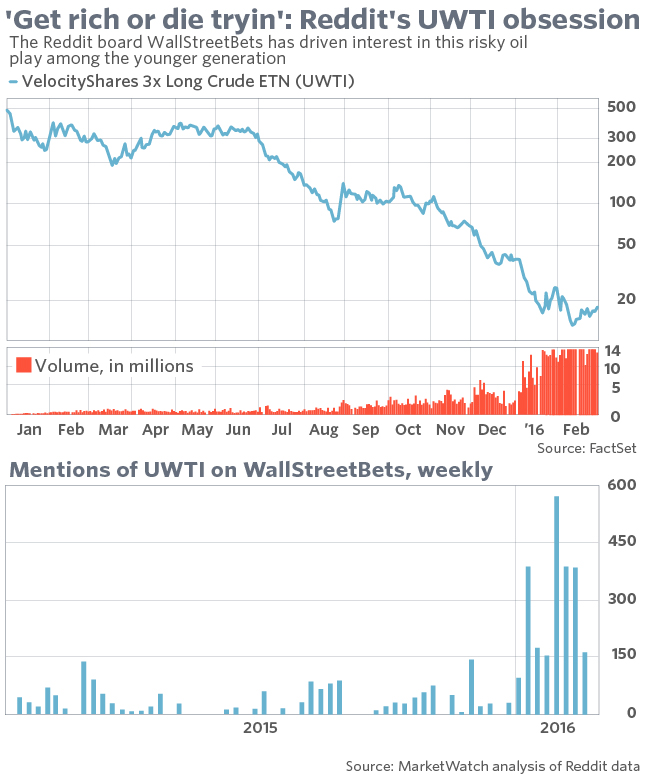

The most recent fixation on WallStreetBets is UWTI UWTI, -2.23% an trade exchanged note that has turned into a most loved of more youthful financial specialists — much appreciated, to a limited extent, to the Reddit gathering. It is a close impeccable exemplification of the YOLO soul: Profoundly unpredictable, it utilizes a mix of subsidiaries and obligation to increase wagers on oil, making open doors for snappy benefits.

What's more, obviously, tweaking misfortunes.

Reddit as money related counselor

Reddit, which calls itself the "front page of the Web," has an accumulation of examination sheets that work more like hive psyche than informal community. Clients vet posts through an arrangement of "upvoting" and "downvoting," and they have demonstrated both devoted to beliefs of free discourse and impenetrable to political accuracy.

While less than 10% of U.S. grown-ups say they utilize Reddit, it has turned into a compelling sounding leading group of super-drew in clients, about 70% of whom are male, while 56% are somewhere around 18 and 29.

In other phrases, it's simply the sort of spot you may anticipate that unruly youthful dealers will assemble in 2016.

All on board the "YOLO" train

"UWTI Forever child!!" a supporter named DrFreshh wrote in December. "History lets you know every one of the examples. It's a big deal win! Been investigating for 20 hours in a row (with the exception of the periodic cigarettes). This is it young men and young ladies! Life investment funds on hold, we have hit the gold mine. Ask me anything and I can let you know for what valid reason its bullish like none other, or the yacht is on me."

At the point when asked what number of shares he expected to exchange, DrFreshh reacted, "100,000. 200,000. that is pennies. This is a chance of a lifetime! I'm going to contribute like its get rich or kick the bucket tryin."

Reddit notice of UWTI, numbered by posts with the ticker in the title, went from one in 2013 and 12 in 2014 to 381 in 2015, as indicated by a MarketWatch examination. In simply the initial two months of 2016, 124 post included "UWTI" in the title. Most were on WallStreetBets.

UWTI positioned fifth in TD Ameritrade's main 10 rundown of shares most exchanged by millennials in 2015; it wasn't among the main 10 most exchanged by more seasoned financial specialists. That is no fortuitous event, as indicated by Rogozinski.

UWTI is "the 3x utilized high-hazard dynamic manufactured subordinate of the month for tenderfoots right now," Rogozinski said. (He has not exchanged it himself: "I've made it past this stage," he said. "Saying this doesn't imply that I didn't exchange something comparative when I experienced my intensive lesson for Divider Road.")

Most dealers don't hold UWTI for more than a couple days; now and again, they are done in minutes. On Jan. 25, it lost more than 22%. On Sept. 1, it sank 21%. In the course of recent months alone, it's dropped twofold digit rates on 27 distinctive days, as per FactSet information. Volume, then, has soared in 2016.

There were a lot of days with upside, as well. UWTI climbed more than 13% one day in Spring. Still, UWTI is down more than 90% in the previous 12 months and is presently simply above $21 per offer. In May 2015, when oil was exchanging above $60 a barrel, UWTI had come to $428.

Indeed, even high schooler Rozanski lost on UWTI. He put $500 on it in the wake of perusing about it on WallStreetBets, losing 20% preceding offering. In any case, he then reserved his huge win, riding alternative wagers against the S&P 500 SPX, +0.44% to win his infamous $900-to-$55,000 benefit.

WallStreetBets has turned into a "stage for millennials like us to find out about UWTI and lose cash," Rozanski said.

'No Compassion Gatherings'

The guarantee of brisk cash has for some time been a draw for speculators with huge aspirations and high resiliences for danger.

"It's the speculator's issue," said Jeff Fischer, a long-term counselor for the Diverse Blockhead, who calls the activity in WallStreetBet reminiscent of the late 1990s, when merchants ran to the Seething Bull and Silicon Financial specialist locales to tout positions. "For whatever length of time that you're profiting, you need to continue playing. Practically everybody just stops after they've lost."

F.S. Comeau, a Montreal-region 30-something, as of late hung up his WallStreetBets mouse after a stretch that landed him in the specialist's office. "I lost well over $150,000 on oil from 2014 to 2015," said Comeau, in an email.

Exchange related anxiety was making Comeau, who said he profited back exchanging alternatives on Apple AAPL, +1.75% , hopeless — and wiped out. "I was around so much I didn't see my portfolio recuperating inside of years, if at any point. I hadn't dozed in 2½ days and I was scarcely holding tight because of caffeine."

Reddit may look rebellious to an outcast, however every board implements its own "Reddiquette," homegrown principles that are close intact on some subreddits. On WallStreetBets, there are two guidelines: "No Compassion Parties" and "Do be mindful giving and taking counsel."

Thus while the discussion's tone is gung-ho, numerous individuals express sympathy toward their kindred speculators, offering defensive, if gruff, opinions. Rogozinski, as far as it matters for him, said he stresses that a gigantic early win can give new brokers a misguided feeling of certainty. "The quicker you go up toward the starting, the harder you fall," he said.

What's more, when one post recently named "New to contributing" approached about the potential for UWTI to ascend to $300 in two years, numerous reactions rather clarified that utilized ETFs rot after some time, and in addition why UWTI isn't intended to be a long haul holding.

"No offense, however the inquiry postured demonstrates you aren't prepared to make that exchange since you obviously haven't looked into what the heck you'd even be purchasing into,"one analyst reacted.

Comeau exchanges less as often as possible now, however he doesn't discount an inevitable come back to WallStreetBets. "I've sufficiently spent restless evenings, and I've laid sufficiently long in bed with my heart pumping," he said. "Unless you've by and by experienced it, you have no clue how hard it is and the toll it can tackle your body."

Youthful speculators are for the most part urged to assume more hazard, since time is on their side. In any case, huge, win big or bust wagers on UWTI are especially risky. "Trust me," said Comeau, "The majority of them, if not every one of them, will be losing cash exchanging it."

Youngster dealer Rozanski, in the interim, conceded that his huge win was "basically blind luckiness." He considered purchasing a Passage Horse with his pull, he said, however chose to keep the cash to store future ventures, celebrating unassumingly: His mother took him out to see "The Big Short," and he purchased another PC with two screens.

"So I can exchange better," he clarified.